RED C UK have released the latest wave of their Consumer Mood Monitor. In field the day after Rachel Reeves sat down, the results give an immediate response to the tax raising measures announced and the impact of policies such as the removal of the universal winter fuel payment.

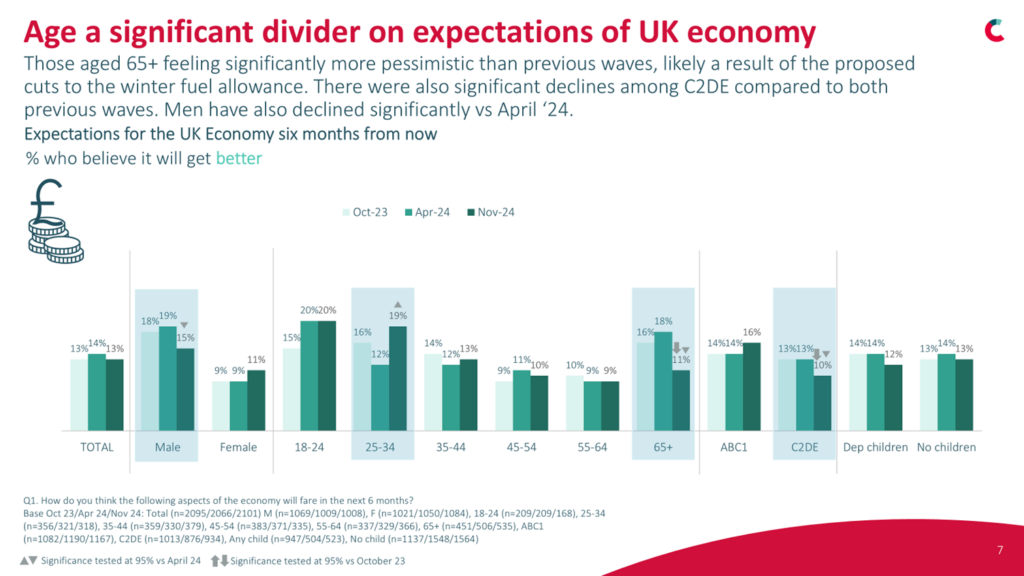

Confidence in the UK economy is down compared to April and slightly below where it was a year ago. Interestingly, the most optimistic group are 18-34 year olds while the percentage of those aged 65 feeling that the economy would improve has almost halved (11% -7PP vs April ’24).

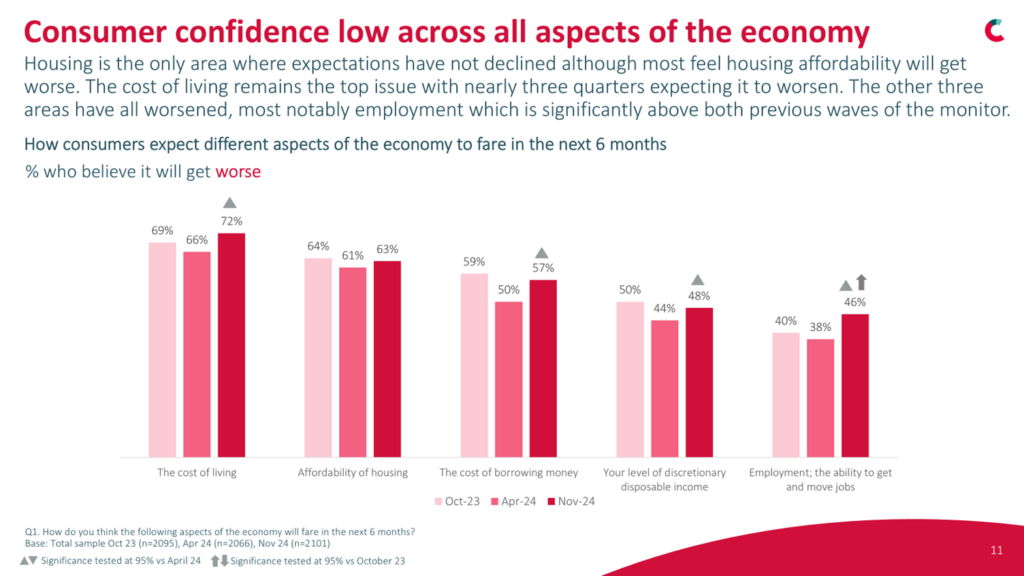

In the two previous waves, concerns were closely linked to rising prices. While this is still the case, the pessimism is more general and widespread. Cost of living is still the top issue facing most consumers with nearly 3 in 4 expecting it to get worse. However, concerns around the ability to get and move jobs is significantly higher than both previous waves of research with just under half expecting it to get worse. Those aged 45 and over are the most concerned about this.

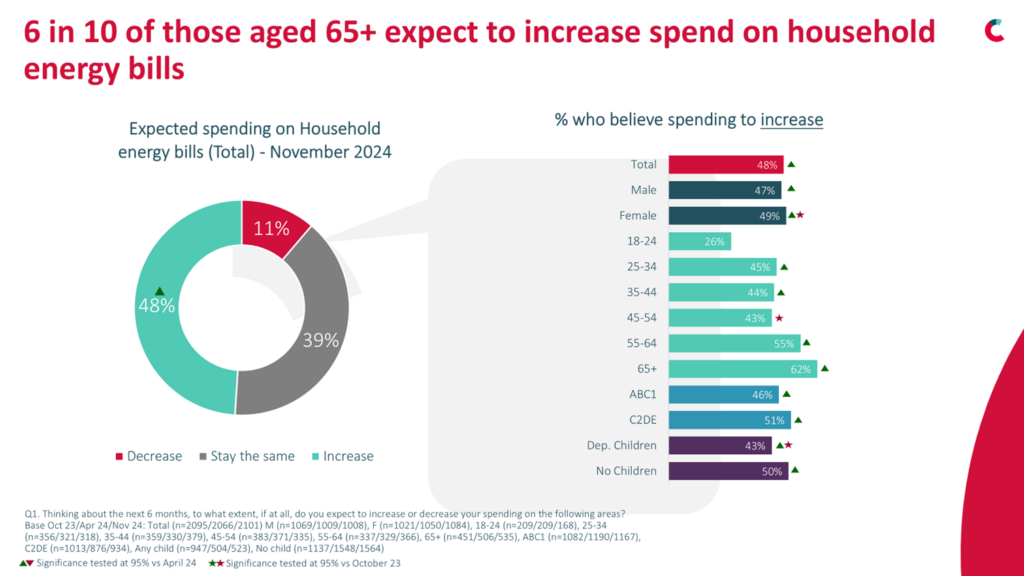

In terms of spending over the next six months: while in April we saw spending expectations for necessities decline, this wave more consumers expect their spending on household energy bills to increase (48% vs 36% in April ’24). This is still slightly lower than a year ago (52% in October ‘24). The group most concerned are those aged 65+, likely an effect of the removal of the winter fuel payment for many pensioners.

Expected spend on groceries and fuel (petrol/diesel) remain largely unchanged from April with around 3 in 10 expecting both to increase. Consumers expect to change their spending on all non-necessities in roughly equivalent ways to our last report in April This includes spending on entertainment outside and inside the home, holidays, consumer goods, and lotteries. The only exception to this is charity donations which are expected to decline. Around half of consumers expect their spending on these to remain the same with the majority of the others expecting it to decrease.