Consumer mood improves after April’s trade war shock, but cost-of-living and both domestic and global economic concerns keep optimism muted

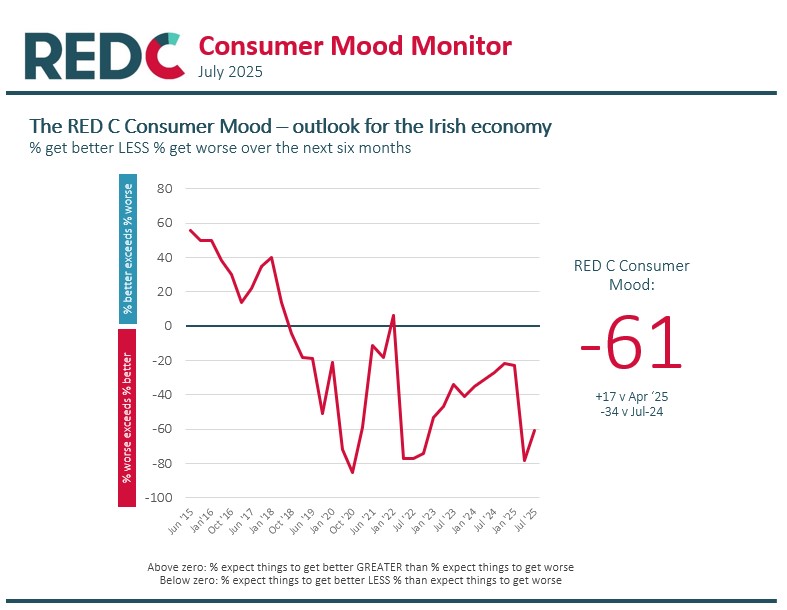

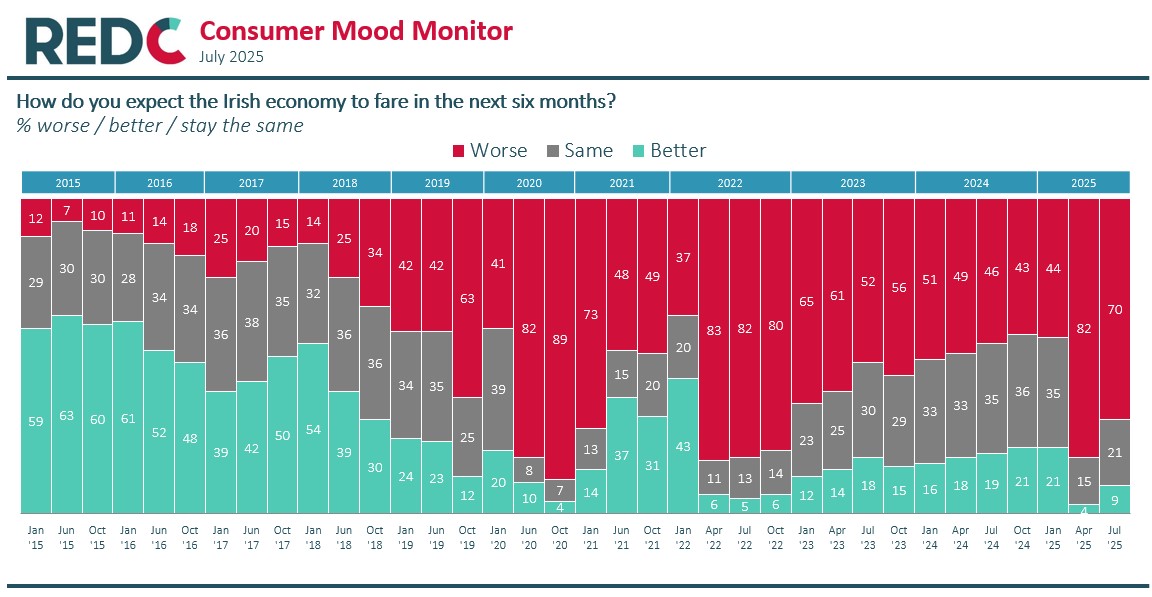

After a sharp drop last April following the US administration’s announcement of new import tariffs, our measure of the Consumer Mood in Ireland has shown some recovery, rising by 17pts to -61 (the % of people that think things will get better versus the % that think it will get worse). While the improvement is notable, overall sentiment remains firmly negative.

While some of the mood music around tariffs has softened and with a deal being struck between the US and EU just after survey fieldwork completed for this edition of the Consumer Mood, there is a still good deal of uncertainty that is no doubt giving rise to concerns for consumers about the outlook for both the global and domestic economies.

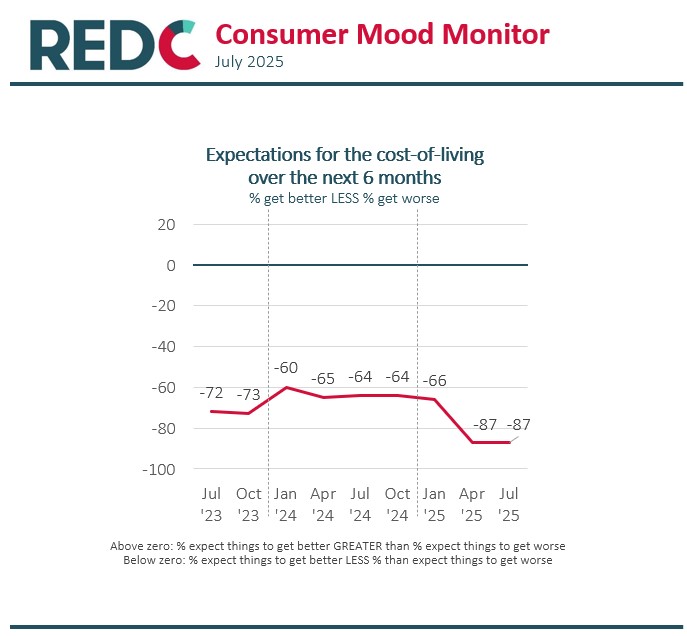

Cost-of-living remains the biggest concern for consumers and while official figures show that headline inflation has been largely stable over the last 12 months, many people are still worried about rising prices especially for essentials like energy and food. This is a key reason why a significant majority of consumers expect their financial wellbeing to deteriorate in the coming six months.

With the Government signalling that the upcoming budget is unlikely to include the same cost-of-living supports seen in previous years (e.g. energy credits) and with growing uncertainty around inflation due to continued the threat of a global trade war, there’s little reason to expect a major improvement in the Consumer Mood in the months ahead.

This wave of the Consumer Mood Monitor takes a deeper look at financial wellbeing, inviting consumers to share in their own words why they expect their situation to improve, stay the same, or worsen over the next six months. With the outlook remaining fragile for many consumers, we also explore how brands can respond meaningfully to growing financial uncertainty.