Are UK consumers bouncing back—or just bracing for what’s next?

Our latest wave of the Consumer Mood Monitor shows consumer confidence has improved since April 2025, but fragility still remains. There’s some optimism, but also a sense that people are just dealing with what life throws at them – resilience is the new optimism!

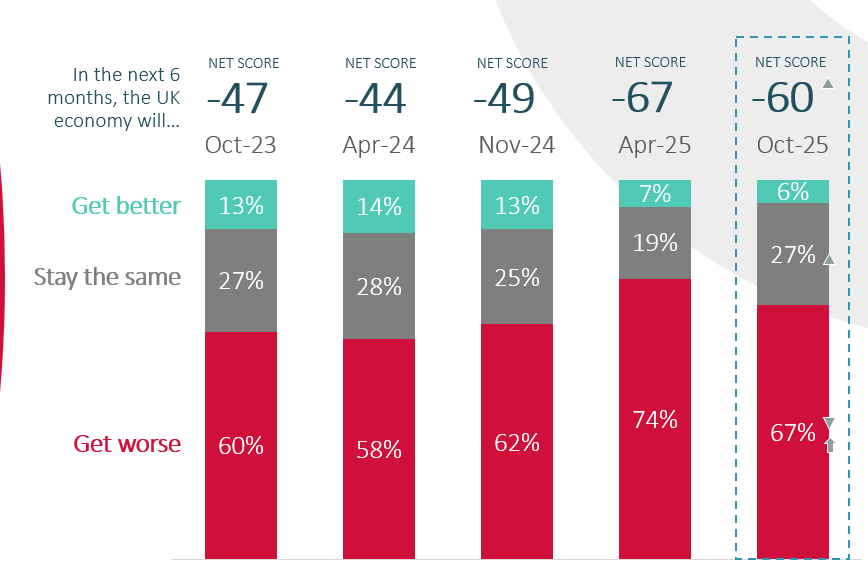

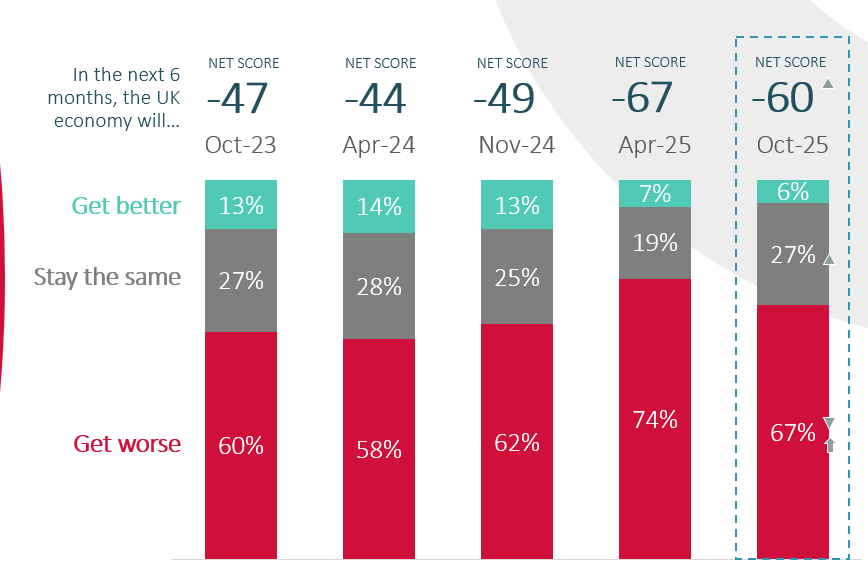

The outlook for the UK economy in the next 6 months is a bit brighter after a difficult start to the year:

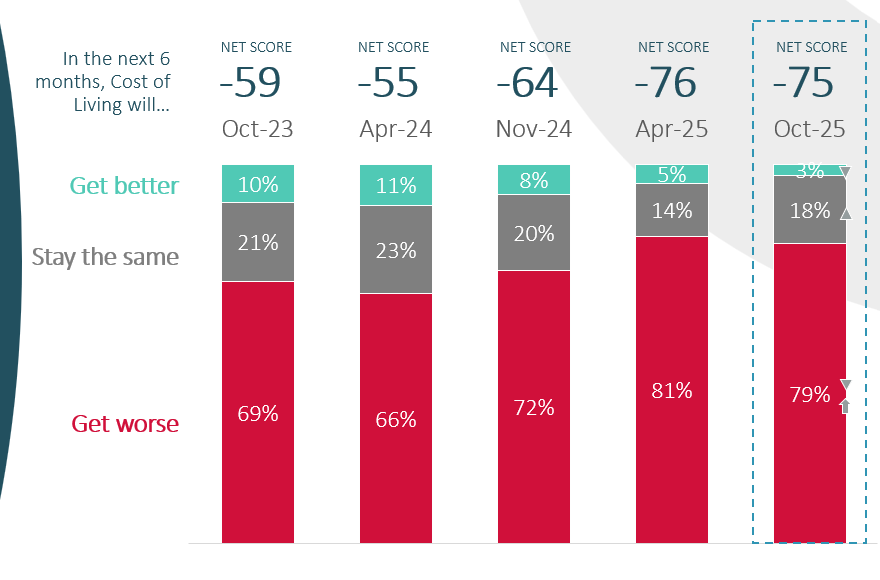

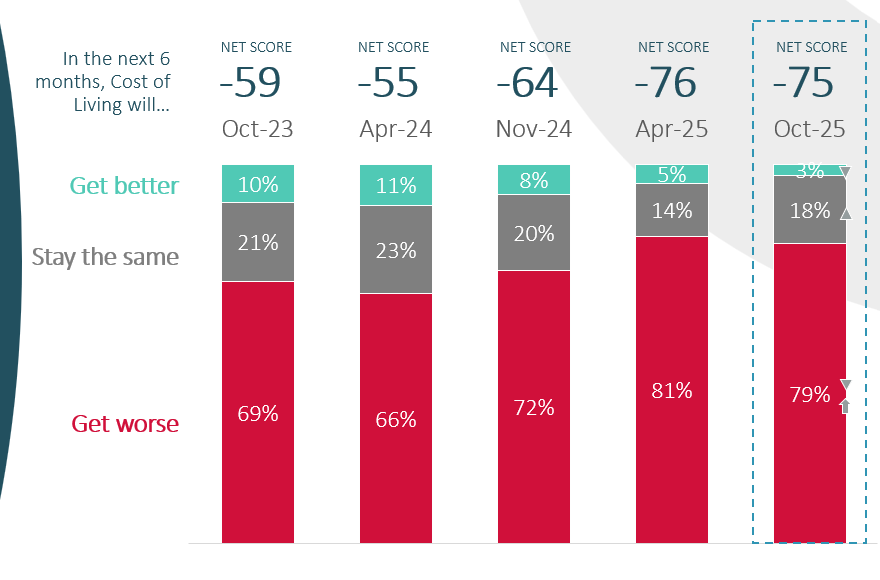

Cost-of-living concerns still dominate—especially around groceries, energy, and housing – 79% expect the cost of living to worsen in the next six months.

Persistent Financial Pressure and Coping Strategies

- Over one-third of consumers are actively cutting discretionary spending, delaying plans, and prioritising essentials.

- Many are switching providers, hunting for deals, budgeting, and even taking on side hustles.

Spending Outlook: Essentials Up, Non-Essentials Flat or Down

- Household energy bills: Majority expect increased spending over the next 6m as the winter season kicks in

- Entertainment & holidays: Most plan to hold steady or reduce spend, signalling cautious discretionary behaviour

- Groceries: With concern over rising food prices and the festive season approaching 38% expect their food bills to increase in the next 6m

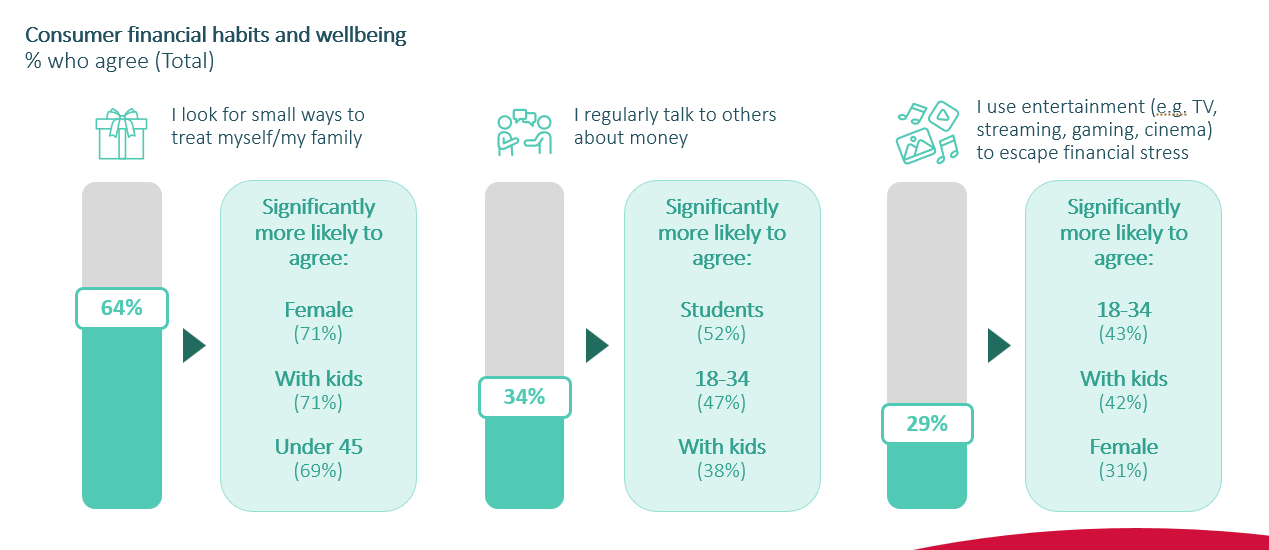

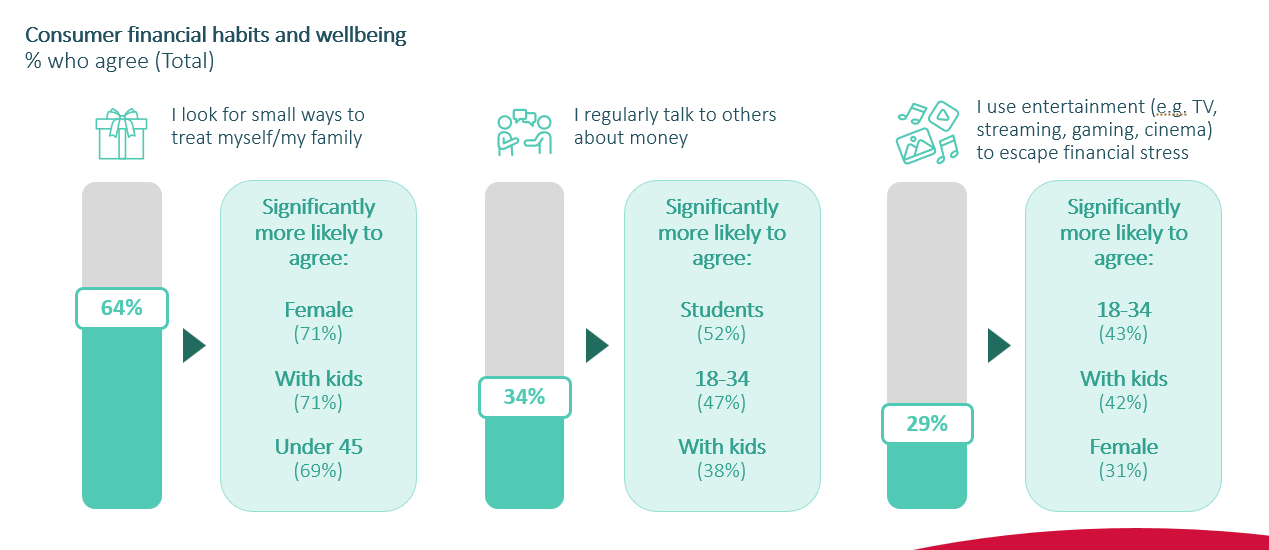

Financial Wellbeing and Emotional Coping

- 45% expect their financial wellbeing to worsen, yet 52% feel confident in managing unexpected challenges.

- Consumers are finding emotional outlets and small joys to stay afloat

Click Here to Download Full Report