The Consumer Mood shows little improvement entering 2026, with cost‑of‑living and housing pressures still weighing heavily. Trade/tariff related uncertainty also dampens confidence, even as expectations for incomes and financial wellbeing edge up slightly. Despite this, early signs of higher discretionary spend suggest consumer willingness to spend has not gone away.

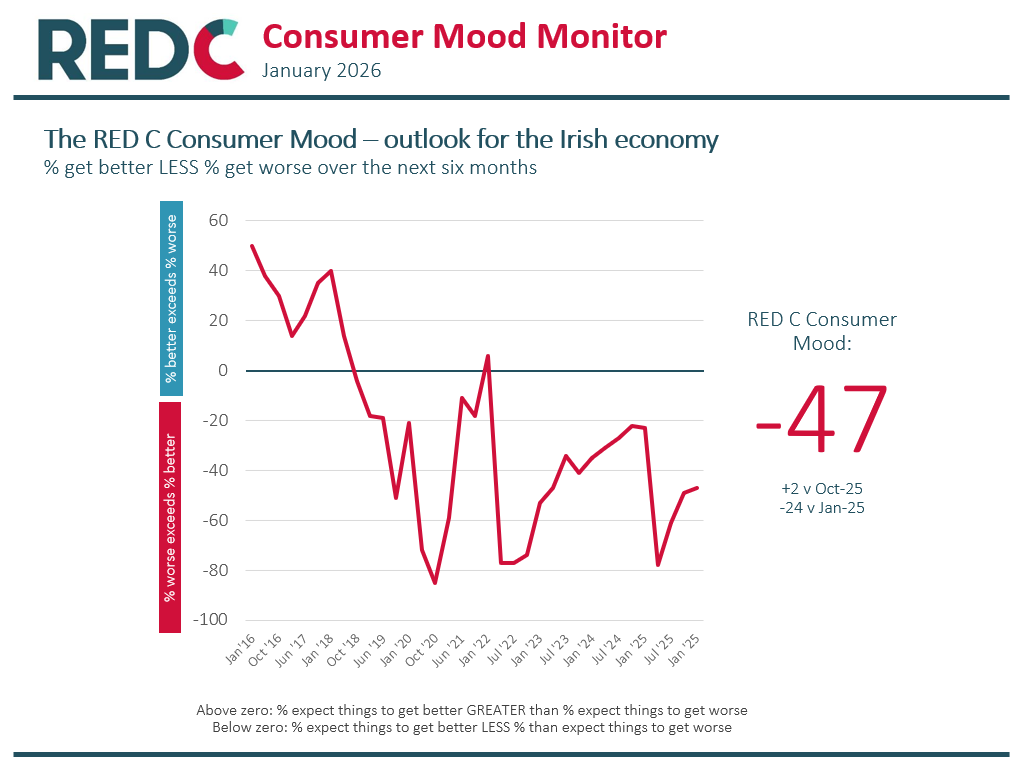

Consumer sentiment shows little movement since October, with the overall mood negative at -47 (+2pts v Oct-25) and dominated by caution. While the modest stabilisation suggests consumers are adjusting to ongoing pressures, optimism is still absent and most continue to expect the economy to worsen in the months ahead. Persistent domestic challenges, notably the cost of living and the continued unaffordability of housing, remain key barriers preventing any meaningful improvement in confidence.

Click Here to Download Full Report

As in previous waves, geopolitical instability (especially the unpredictably surrounding both economic policy and foreign relations in the US) is influencing how consumers view the broader economic landscape, reinforcing the sense of fragility surrounding future prospects. With sentiment toward the world economy deteriorating further, global uncertainty is now an additional layer on top of domestic strains, making consumers more wary about potential disruptions and economic risks in the year ahead.

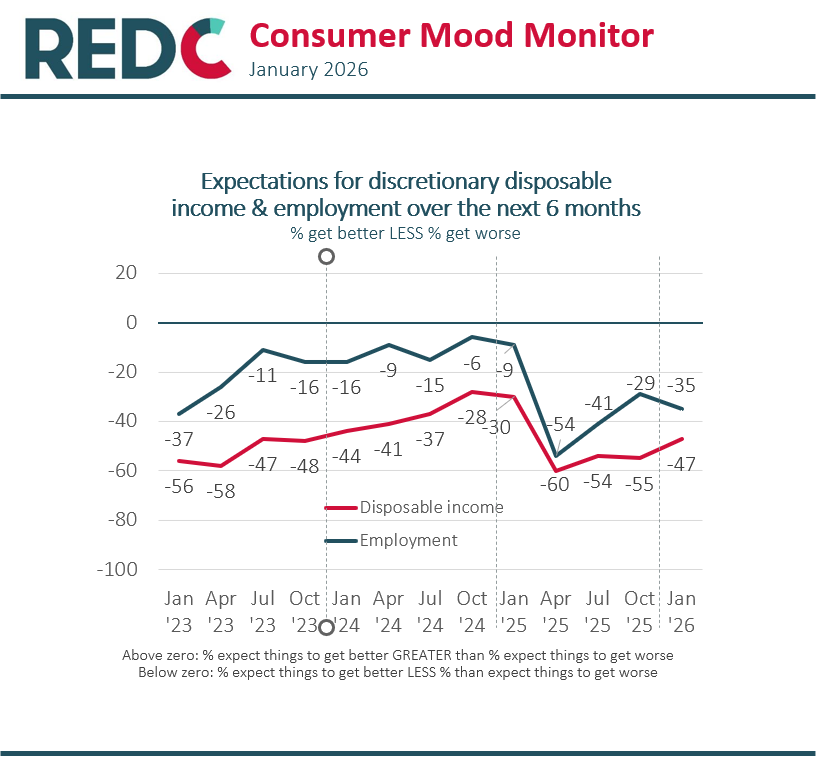

Notably, worry about the jobs market has increased, driven by recent signs of softening in employment indicators. Yet, somewhat counter‑intuitively, concerns about disposable incomes have eased, with expectations for household finances and financial wellbeing improving slightly relative to late 2025. While still negative overall, these shifts suggest consumers are feeling marginally steadier in their day‑to‑day finances.

Despite overall economic pessimism, the January data points to early indications of a spending pick‑up, particularly across entertainment and holidays. At the same time, expectations around household energy bills and motor fuel have eased slightly. The data suggests that while essential costs still weigh on household budgets, consumers appear more willing than in recent months to loosen spending in selected categories in the coming six months.