With the budget less than a month away and a general election looming, how are consumers feeling about the current economic climate and the outlook for the Irish economy over the coming months? The RED C Consumer Mood Monitor reveals that despite modest improvements in consumer confidence, it remains generally downbeat with cost-of-living pressures continuing to shape spending habits and overshadow sentiment.

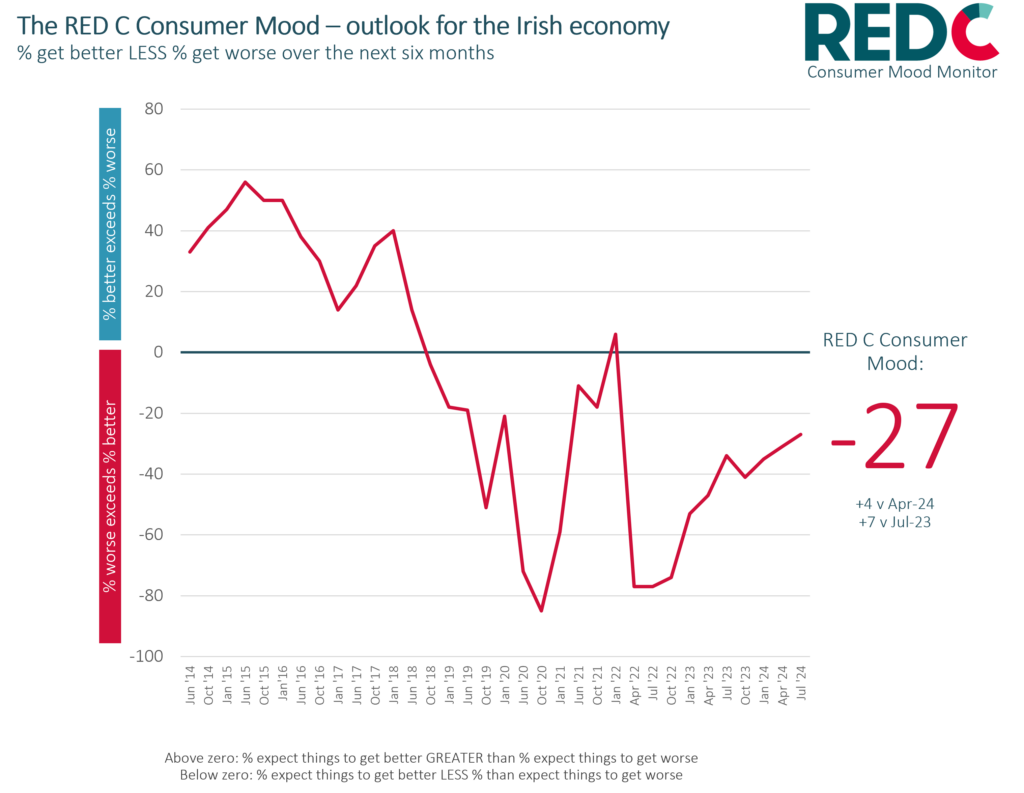

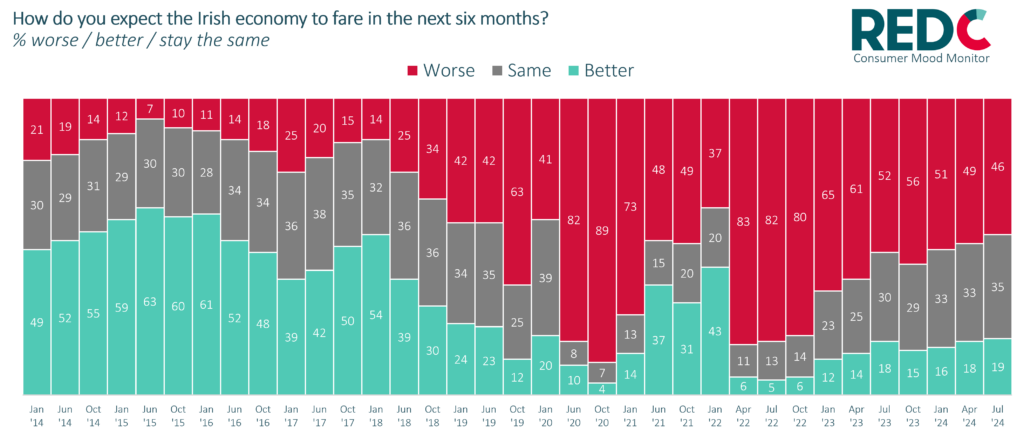

While up slightly on recent waves, consumer confidence remains negative overall. Fewer are expecting the economy to worsen further than previously, mostly because more now expect it to fare the same, with only a handful expecting an improvement in the second half of 2024.

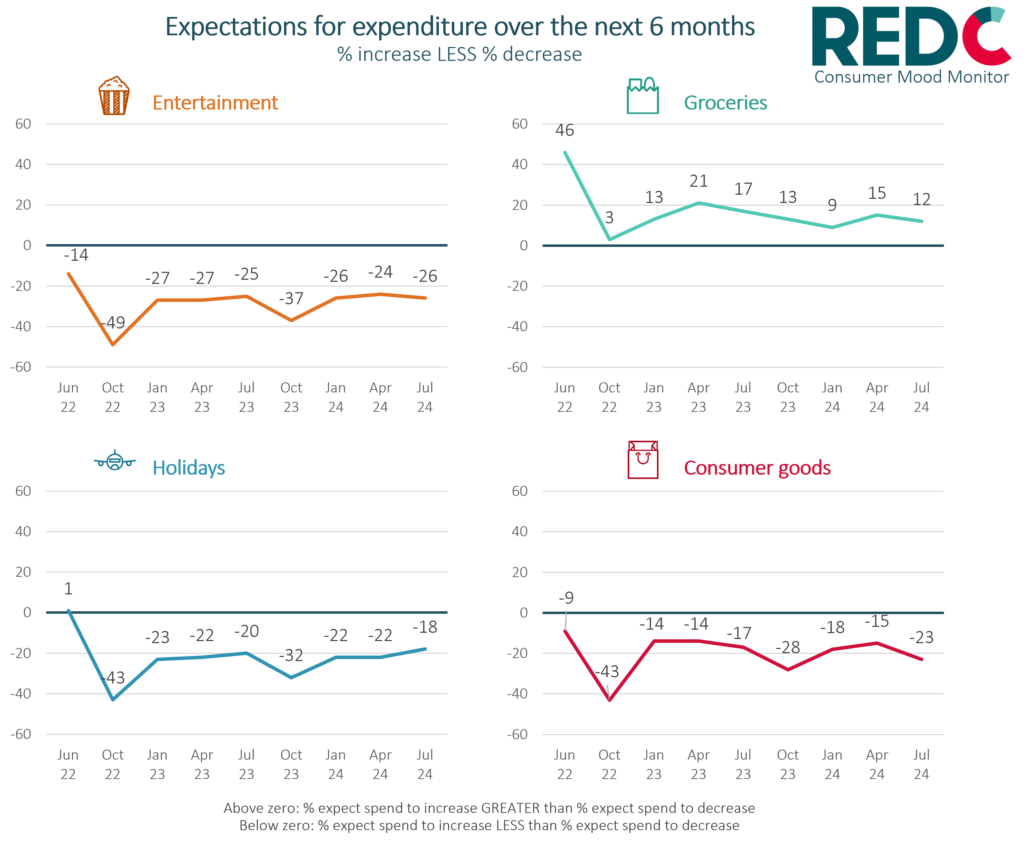

Confidence remains low in all areas of the economy including the affordability of housing; one’s own financial wellbeing; the cost of borrowing; and the jobs market. Concerns around discretionary income and cost of living are playing a far more dominant role than job market anxiety in shaping the current consumer mood.

Although fewer consumers expect the economy to worsen, their outlook remains bleak, with the majority bracing for further increases in grocery, energy and fuel costs. There has been a steady improvement in disposable income over the past two years. However, many will prioritise daily living expenses over discretionary spending on items such as entertainment, holidays and consumer goods.

An election budget, particularly with the promise of a cost-of-living package, could lift consumer confidence. However, gains may be short-lived as some of the big issues such as the housing crisis and cost of living combined with outside global factors are unlikely to be resolved in the short term.